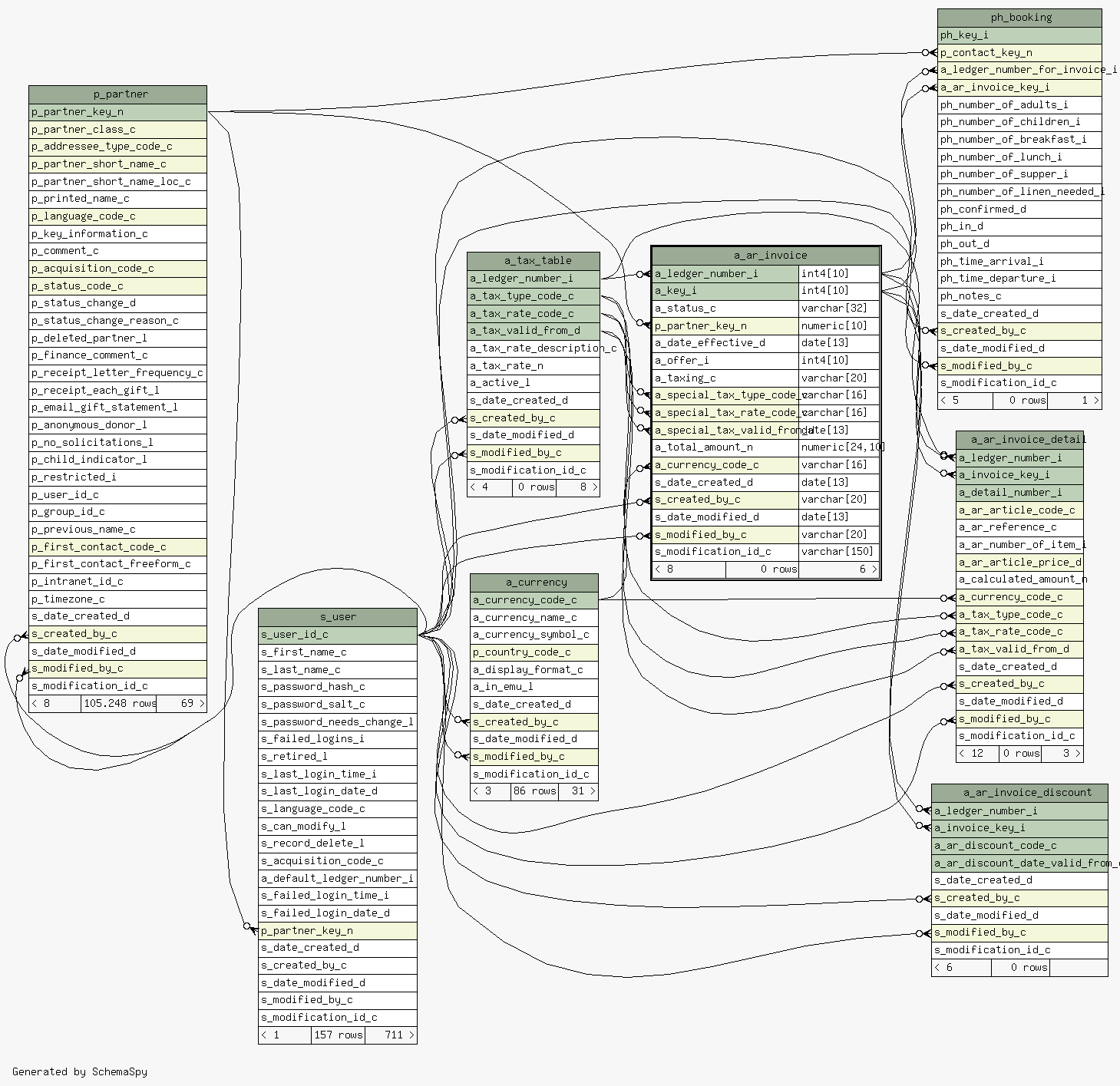

| Table openpetra_trunk.public.a_ar_invoice the invoice (which is also an offer at a certain stage)

|

Generated by SchemaSpy |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table contained 0 rows at Do Nov 10 18:00 MEZ 2011 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Indexes:

| Column(s) | Type | Sort | Constraint Name |

|---|---|---|---|

| a_ledger_number_i + a_key_i | Primary key | Asc/Asc | a_ar_invoice_pk |

| p_partner_key_n | Performance | Asc | inx_a_ar_invoice_fk1_key1 |

| a_ledger_number_i + a_special_tax_type_code_c + a_special_tax_rate_code_c + a_special_tax_valid_from_d | Performance | Asc/Asc/Asc/Asc | inx_a_ar_invoice_fk2_key2 |

| a_currency_code_c | Performance | Asc | inx_a_ar_invoice_fk3_key3 |

| s_created_by_c | Performance | Asc | inx_a_ar_invoice_fkcr_key4 |

| s_modified_by_c | Performance | Asc | inx_a_ar_invoice_fkmd_key5 |

| a_ledger_number_i + a_key_i | Must be unique | Asc/Asc | inx_a_ar_invoice_pk0 |

|